But again in real life it’s not like an LBO model, where you could conceivably make it noncircular by changing around a few things. The last thing I want to do here is look at the optional debt repayments, and the cash flow available to repay debt. In this lesson, you’ll learn how to allocate the funds required between equity and debt tranches, and how you can ensure that the proper amounts are drawn each month. As we’ve mentioned above, traditional real estate financial models may give you solid projections going into an investment, but they leave you unable to adapt and re-strategize in real time.

Read how Synario helped SABRA accelerate their financial modeling process.

We will change it a little bit because we plan to boost rents up to market rates by lightly renovating the units. All investing is probabilistic, so a simple model cannot tell you if a property will generate an 11.2% or 13.5% annualized return. We focus on commercial real estate (CRE) that is purchased and then rented out to individuals or businesses, as opposed to residential real estate, such as single-family homes, that is owner-occupied and not rented out to others. With this sort of model, you could test multiple scenarios at once, envision every possible future reality, and plan accordingly.

A.CRE Library of Excel Models

Ultimately, what you need is multi-year real estate financial modeling that prepares you for any scenario. This way, you know what route to take when something as unprecedented as the Coronavirus arrives. 1) Cash Flow Projections – You need to understand how to move from a property’s tenants, rents, expenses, and debt and equity to its cash flows – and model the changes over time on the pro-forma. Upon stabilization, so-called “permanent” or long-term financing can be placed and used to take out construction financing.

The Step-by-Step Process to Real Estate Financial Modeling

And you have the tools at your disposal to either give yourself shelter from the storm or stop the storm altogether. If you’re serious about your future career in real estate, you should not even have to think about this one. We could sell each component of this course separately for $97 each, for a total of $679, but since we want you to get “the full package,” we’re discounting it to just $247. But when you invest in the Real Estate Modeling course, personal support is included for FREE.

- I’m just going to do it this way, so if we have a breaker it’s set to zero to avoid a circular reference, here.

- Next, we assume that a Construction Loan is used to fund part of the development costs.

- They put a plan in place for whatever tomorrow brings and give you the tools to take successful action.

- Be sure to confirm that they can only view limited information that won’t compromise your strategy, though.

- They can also better mitigate risks by accounting for all scenarios and potential challenges, such as a pandemic.

You should not invest unless you can sustain the risk of loss of capital, including the risk of total loss of capital. Diversification does not guarantee investment returns and does not eliminate the risk of loss. All investors should consider their individual factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate.

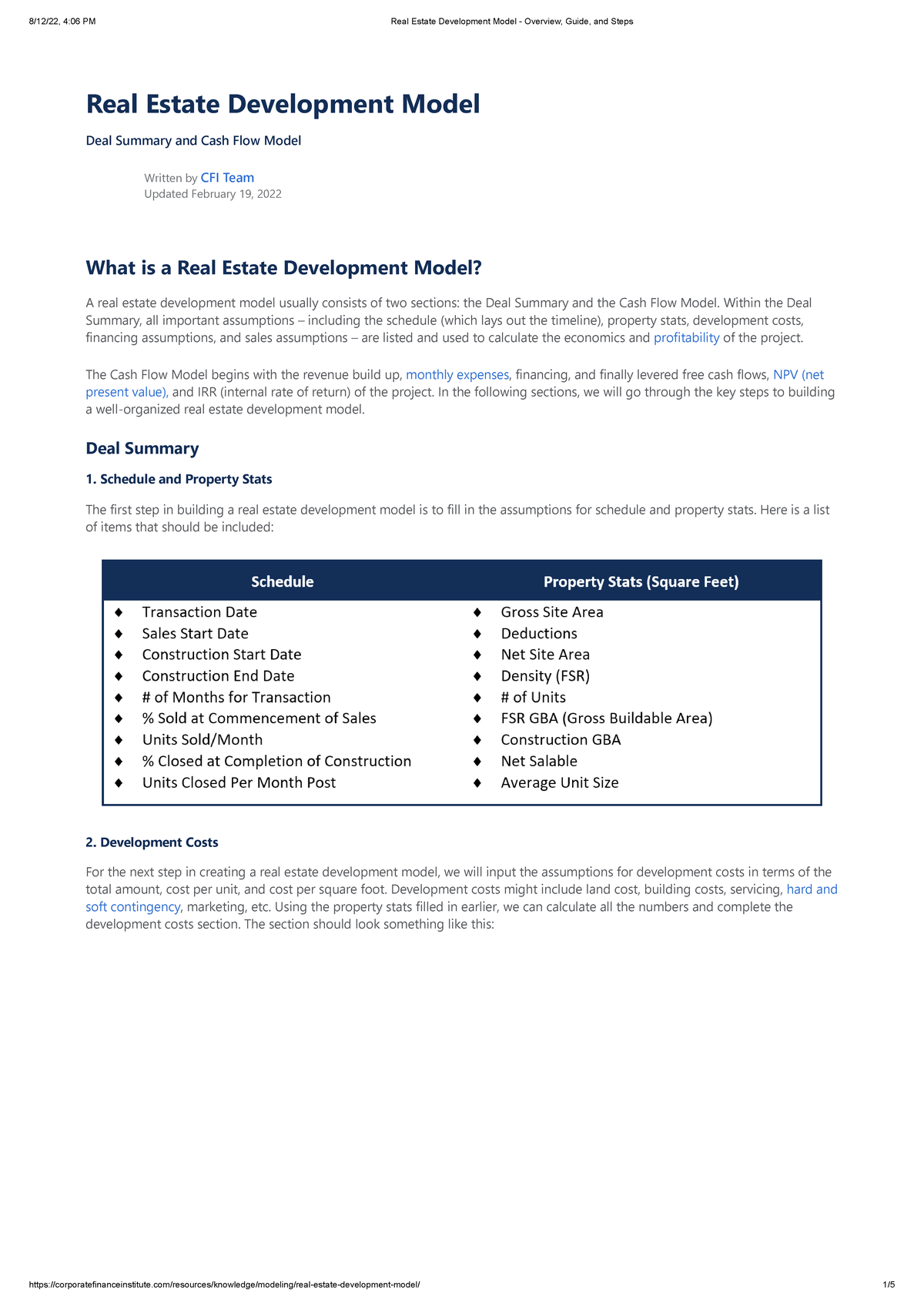

As with much of the rest of this model, if you’ve already been through the LBO models elsewhere in this course, these formulas will seem very familiar to you. Because conceptually, the way we set them up, is actually very similar to what you do in an LBO model, when you’re determining the optional debt repayments. So at least this part here at the bottom, for optional debt repayments, is going to be similar to what you’ve seen, before if you’ve been through those models. Real estate development, or property development, is a business process, encompassing activities that range from the renovation and re-lease of existing buildings to the purchase of raw land and the sale of developed land or parcels to others.

That is what is going to tell us that our model is actually working in the end. And then the draw here is never going to be negative either, it’s only going to be positive or zero, so this part can never be negative. And then the second part here, this can’t really be negative, either, because the cash flow available we’ve done a check here, and we’re only listing zero or positive numbers. And then the repayments so far, it’s not possible for those to exceed cash flow available for debt repayment, so we do not need a MAX function, around this one either.

But then senior notes A we’ve flipped the order around, so I’m just changing that right now to F117. Just a quick check there it’s a common mistake to mess this up, because the order of repayment is different from the order of the draws. I’m going to say IF the net income here is; or really if the cash flow from operations is positive; if it’s above zero we’re going to take this number, otherwise we’re going to say zero for this. We could also check for circularity itself and if that is set to no, then we could also do a hard reset. I’m just going to do it this way, so if we have a breaker it’s set to zero to avoid a circular reference, here. Otherwise we’re going to sum up everything on our statements, for the capitalized interest, right here.

…or you can confidently tell them you’ve completed the most targeted real estate financial modeling training available, based on 11 case studies and authored by finance professionals who have collectively worked on dozens of deals. Then, you’ll set up the acquisition, exit, and financing assumptions, project the Debt service, calculate the returns to the equity investors, and set up sensitivity tables to analyze the deal outcome under varied assumptions. You will also add support for tenants with different lease types, calculate returns to both the equity and mezzanine investors, build a mixed IRR/multiple-based waterfall schedule, and add support for the Lookback Provision using VBA code. In this module, you will complete a 4-hour real estate development modeling test for an office property in the City of London (100 Bishopsgate). You will expand on the simplified 90-minute version in the introductory module and build in support for a monthly schedule with flexible refinancing and exit dates and multiple scenarios.

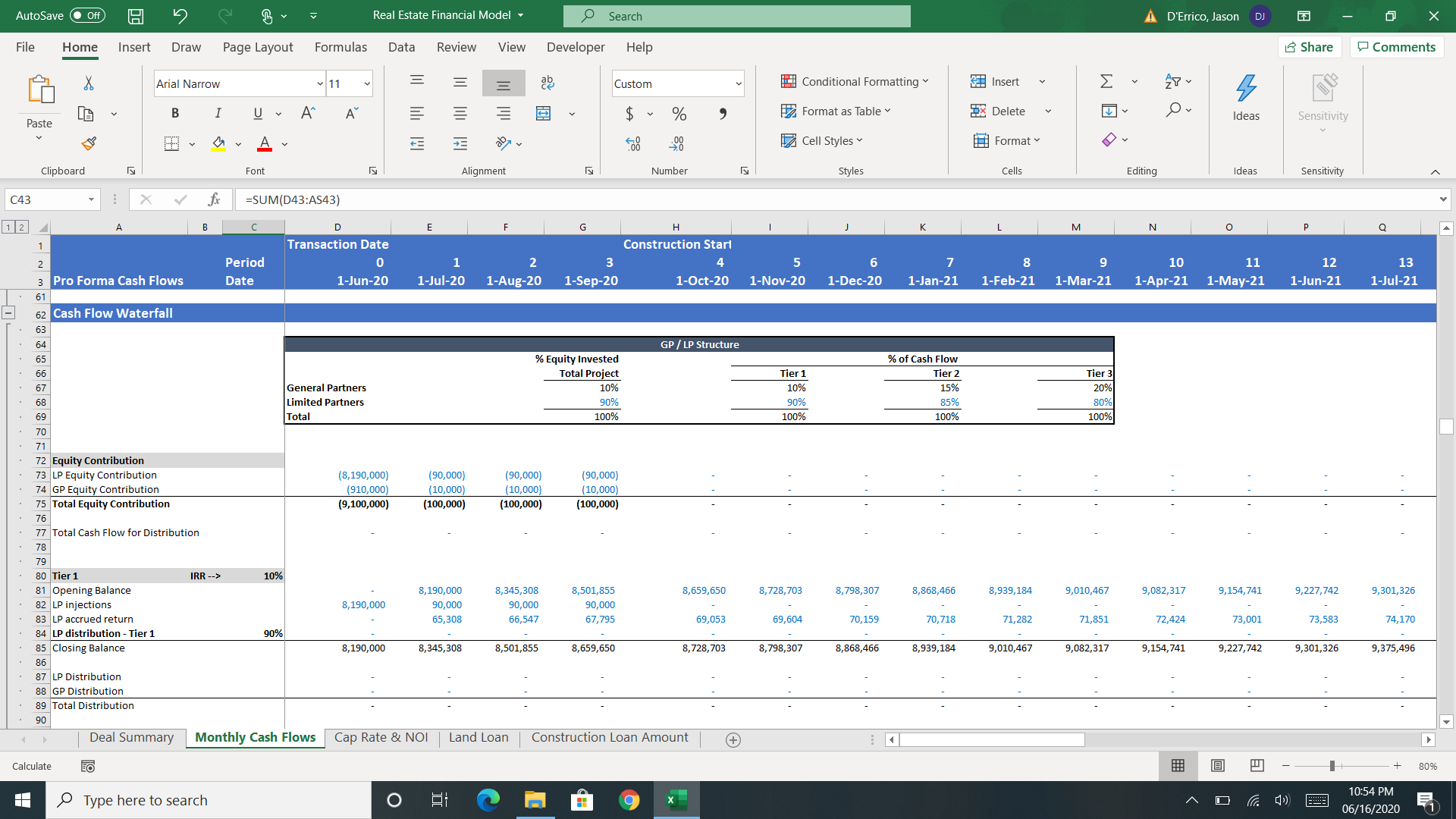

Then when we can no longer afford investor equity, that’s when we switch to mezzanine. You can see it’s mostly being used to finance the hard cost of construction here. Now in terms of the draws themselves, let’s just take a look at what’s going on here. So developer equity we’re drawing it for the first three months, mostly to pay for the land actually, if you think about the numbers here. The answer is that, unlike a traditional LBO model, it’s not really going to happen here, because of the way we’ve set this up.

Modules on the other hand are meant to add to an existing model for further analysis. The partnership-level cash flows need to be modeled separately, and then linked to the waterfall to calculate the partnership-level returns. In more complex real estate financial modeling exercises, we fix this issue by making the entire calculation circular, but it’s not worth the time/hassle/headache in a quick model like this one. The last steps in a real estate development model, such as the operating assumptions, pro-forma, and returns calculations, are similar to the ones in the acquisition model above. In real estate financial modeling, these metrics are important for both lenders (they indicate downside risk) and owners (they indicate Debt capacity).